📊 Scenario Math, Done Right

From today’s EV to 5-year outcomes - without fantasy.

Price targets anchored to vibes don’t travel well. A durable framework starts at today’s enterprise value (EV₀) and projects cash, not headlines. If FCF/share rises while the multiple doesn’t need to, you’re compounding for the right reason. Scenario math forces discipline: define growth, margins, and a credible terminal multiple—then see what falls out.

🧱 The three building blocks

You only need three levers (plus share count hygiene):

Revenue growth: the 5-year Rev factor = (1+g)^5

Cash conversion: FCF margin glides from today to Year-5 (Y5).

Terminal valuation: an EV/FCF(Y5) band that peers and quality justify.

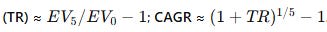

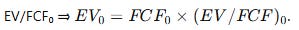

Put simply: EV₅ = FCF₅ × (EV/FCF)₅, where FCF₅ = Rev₀ × Rev factor × FCF margin₅.Your Total Return (TR)=

🧮 A simple 5-year model (with numbers)

Assume today: Rev₀ = $200m, FCF margin₀ = 5% → FCF₀ = $10m. Stock trades at EV/FCF₀ = 60× → EV₀ ≈ $600m.

Model: Rev CAGR = 18% → Rev factor ≈ 2.29; FCF margin₅ = 20%.

Then: FCF₅ ≈ 200 × 2.29 × 20% = ~$91.5m.

Pick EV/FCF₅ = 25× (quality, but not heroic).

EV₅ ≈ 25 × $91.5m = ~$2.29b.

TR ≈ 2.29b / 0.60b − 1 ≈ +281%; CAGR ≈ ~31%/yr.

Note the shape: EV/Sales can fall while EV/FCF falls less, because FCF margin rises. That’s the glide you want—cash, not rerating, drives returns.

🐂/⚖️/🐻 Weight it like an owner

Define ranges, not dreams. Example (same starting point):

Bull (30%): Rev CAGR 22%, FCF margin₅ 22%, EV/FCF₅ 28× → TR ~+360%, CAGR ~35%.

Base (50%): Rev CAGR 16%, FCF margin₅ 18%, EV/FCF₅ 23× → TR ~+190%, CAGR ~24%.

Bear (20%) (constructive): Rev CAGR 10%, FCF margin₅ 14%, EV/FCF₅ 18× → TR ~+70%, CAGR ~11%.

Weighted expected ≈ +214% total (≈ ~25%/yr). The bear still makes money because cash improves—even if growth slows and the terminal multiple is stingy.

🧪 Guardrails that keep you honest

Terminal sanity: EV/FCF₅ above peer medians demands evidence (moat, NRR, pricing power). Otherwise cap it.

Bridge, not EBITDA: Reconcile EBITDA → OCF → FCF; if OCF < growth capex for two quarters, haircut margins.

Dilution hygiene: Model net shares +1–2%/yr unless you have proof otherwise; always track FCF/share, not just FCF.

Compression welcome: A good model survives EV/Sales compression because FCF/share climbs. If your IRR needs rerating, rewrite it.

🎯 Copy/paste template (work the numbers)

Input: Rev₀, FCF margin₀

Choose: Rev CAGR, FCF margin₅, EV/FCF₅.

Compute: Rev factor, FCF₅, EV₅ ⇒ TR, CAGR.

Build Bull/Base/Bear; weight 30/50/20; derive expected TR & CAGR.

Sanity-check against peers; adjust if OCF<capex or dilution >2%/yr.

Decision: Add if cash path prints two quarters; trim if multiple outruns cash; exit on broken bridge.

Anchor to today’s EV, let FCF/share do the lifting, and make the terminal multiple earned, not imagined. Scenario math won’t predict the future - but it will stop you from paying for one you can’t afford.

Disclaimer

This publication is for educational purposes only and reflects personal opinions at the time of writing. It is not investment advice and not a recommendation to buy or sell any security. Past performance (including the >22% average annual return since 2005) is not a guarantee of future results. Investors should conduct their own research, consider their objectives and constraints, and size positions appropriately. Positions discussed may be held by the author and may change without notice.