A $1.68T Platform Trading Like a Melting Ice Cube

This isn’t a “back to 2021” nostalgia trade. It’s a cash-generative platform rebuild where product + mix + buybacks can compound per-share earnings for years.

PayPal is one of those stocks that almost nobody wants to love right now. The narrative is familiar: Apple Pay everywhere, Stripe winning mindshare, branded checkout “declining,” Venmo “never monetizes,” and the whole thing is just an ex-growth legacy payments company.

That narrative is exactly why the opportunity exists.

When a platform business gets written off, the market tends to price it like it’s structurally broken. But sometimes the business isn’t broken — it’s just transitioning from a growth-at-all-costs phase to a profitability and product-quality phase. PayPal is in that transition now, and the numbers already show what the market is missing: the company remains massive, profitable, and capable of meaningful per-share compounding.

In 2024, PayPal processed $1.68 trillion of total payment volume (TPV) and ended the year with 434 million active accounts. That’s not a niche player. That’s infrastructure.

The multi-bagger question is not “Can PayPal grow like a startup again?” It’s: Can PayPal return to durable, profitable mid-single-digit platform growth — while shrinking the share count and earn back a market multiple that isn’t anchored to pessimism?

I think the answer can be yes. And if it is, the path to a multi-bagger is not fantasy math.

Why PayPal is even on a multi-bagger list

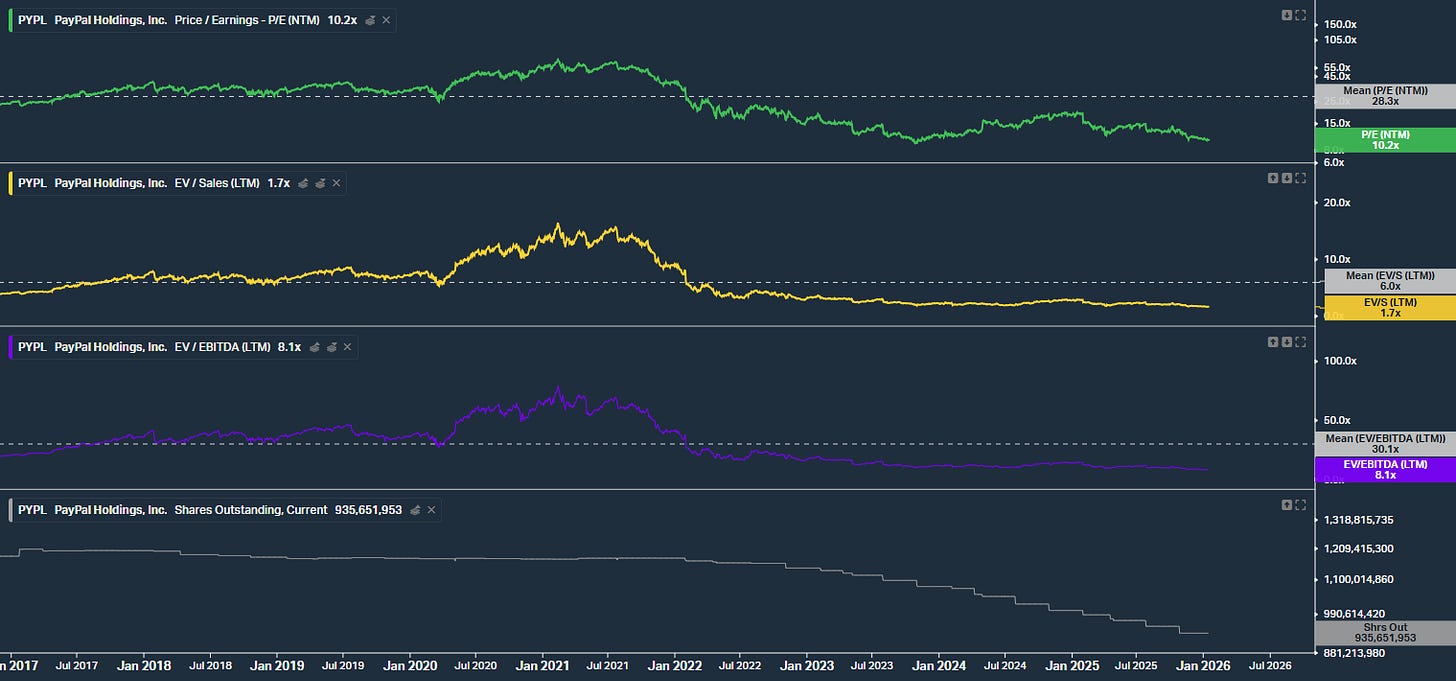

Most multi-baggers come from small caps. That’s true. But there’s a second category that can produce multi-bagger outcomes: large caps that get de-rated so hard that the recovery becomes asymmetric.

PayPal is a platform with:

enormous scale (TPV measured in trillions),

high “default relevance” in global online commerce,

real operating profits,

and the ability to repurchase stock aggressively.

Those ingredients can generate a multi-year, per-share earnings compounding story even if top-line growth is merely “good,” not explosive.

And PayPal itself is explicitly framing the next phase as profitable growth, with a focus on transaction margin dollars and EPS expansion. At its Investor Day in early 2025, the company reiterated 2025 guidance and laid out an outlook by 2027 targeting high single-digit transaction margin dollar growth and low-teens+ non-GAAP EPS growth.

When a platform of this scale tells you it expects low-teens+ EPS growth over multiple years, you should listen - not because management guidance is gospel, but because it defines what they’re optimizing for.

What changed:

One of the most important lines in PayPal’s filings over the last year is that the company deliberately leaned into a “profitable growth” posture that temporarily hurt volume in parts of the business.

In the 10-Q for the quarter ended June 30, 2025, PayPal said that because of its stronger focus on profitable growth and ongoing negotiations with merchants, it saw lower volume and transaction revenue from Braintree in the first half of 2025 and expected Braintree volume to return to growth in the second half of 2025.

That sentence is not exciting. But it’s the kind of sentence that often marks the start of a multi-year recovery: a platform choosing to stop “buying” volume and instead rebuild unit economics.

The second change is product velocity. PayPal is trying to modernize checkout and reduce friction because in payments, the best product is the one that converts.

The underappreciated metric: PayPal’s platform is still growing where it matters

Look at the operating core in mid-2025. As of June 30, 2025, PayPal reported 438 million active accounts (up 2% year over year). In Q2 2025, PayPal processed $444B of TPV (up 6% year over year).

Now, bears will point out that payment transactions declined year-over-year in that quarter. That’s fair — and it’s exactly why “mix” matters. PayPal is explicitly saying transaction revenue growth lagged TPV growth due to product mix, merchant mix, and hedging impacts.

This is where many investors lose the thread: they treat headline revenue growth as the only truth. In payments, a company can be strategically improving the business (better margin dollars, better monetization, better conversion) while revenue growth looks mediocre.

PayPal’s own reporting highlights “transaction margin dollars” as a profitability indicator. In Q1 2025, transaction margin dollars were $3.716B, up 7% year over year, and non-GAAP operating margin improved. That’s the shape of an optimization story.

The real lever: fixing checkout conversion with Fastlane

Fastlane is one of the most important PayPal initiatives in years because it addresses the core problem in e-commerce: guest checkout friction.

In early 2024, PayPal introduced Fastlane as a one-click guest checkout experience. In pilot results disclosed by PayPal, Fastlane recognized 70% of guests and accelerated checkout speeds by nearly 40% compared to traditional guest checkout.

Later, PayPal pushed distribution through partnerships. For example, PayPal expanded collaborations where partners (like Global Payments and Fiserv) can offer PayPal/Venmo branded checkout and Fastlane to more merchants.

Here’s why this matters: conversion improvements are a compounding advantage. If merchants see higher conversion and better checkout completion, PayPal becomes less of a “button” and more of a revenue lever. That changes pricing power, retention, and volume stability.

Fastlane is not a guaranteed win. But it’s a credible attempt to rebuild relevance at the exact moment when “PayPal is outdated” became consensus.

Venmo: the monetization story is no longer theoretical

Venmo has been mocked for years as “a great product with weak monetization.” The important part is that PayPal keeps expanding Venmo into broader commerce use cases (merchant acceptance, cards, and checkout inclusion).

PayPal has been explicitly integrating Venmo and PayPal products into partner distribution (again: Fiserv/Global Payments partnerships reference Venmo branded checkout).

This matters because Venmo’s edge is cultural and behavioral — it’s a habit. When habits get embedded into merchant checkout flows, monetization becomes less optional.

I’m not underwriting PayPal on “Venmo becomes a super-app.” I’m underwriting it on a more sober claim: Venmo becomes a more material contributor to transaction margin dollars over time as it shows up in more commerce lanes.

The “platform unification” angle: PayPal Open

Another under-discussed piece: PayPal wants to simplify its merchant integration surface and make it easier for businesses and partners to plug into its ecosystem.

At Investor Day 2025, PayPal introduced PayPal Open described as “one platform for all businesses,” integrating payments, financial services, and risk solutions, plus external commerce partners.

This sounds like corporate-speak until you remember what PayPal is fighting: friction and fragmentation. Payments is a scale business, but it’s also an integration business. The easier the integration, the wider the funnel.

So where does the multi-bagger come from? (The non-delusional version)

A true multi-bagger in PayPal doesn’t require a miracle. It requires a sequence of reasonable things:

Branded checkout stabilizes and gradually re-accelerates through better conversion (Fastlane) and better merchant distribution.

Braintree returns to growth after margin/price normalization, as PayPal itself expects.

Transaction margin dollars compound at mid-single digits to high single digits (the company’s own framing), while opex discipline supports operating leverage.

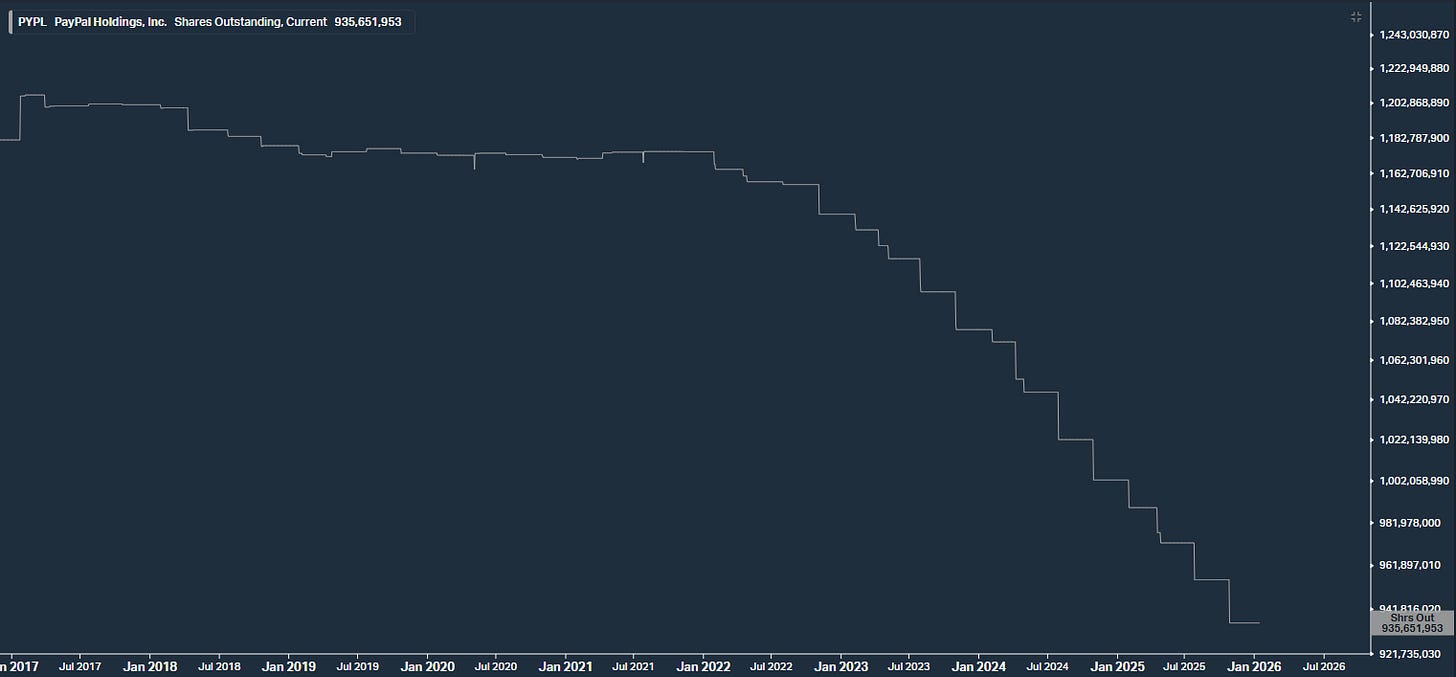

Share count declines materially through buybacks, turning “okay” business growth into stronger per-share earnings growth.

The market stops valuing PayPal like a melting ice cube and starts valuing it like a stable platform again.

PayPal’s own 2027 outlook points to low-teens+ non-GAAP EPS growth as the internal target. If a company compounds EPS in the low teens for several years and retires shares, the stock does not need heroic multiple expansion to do well. Any multiple expansion becomes upside.

I’m not going to pretend you can spreadsheet your way to certainty here. But I will say this: the market often prices “decline” long before the business actually declines. And PayPal’s metrics TPV growth, active account growth, transaction margin dollars growth don’t match a terminal-decline story.

Risks that matter

The bear case isn’t stupid. There are real risks:

Competition is relentless. Apple Pay owns the device layer. Stripe owns developer mindshare. Adyen owns enterprise narratives. If PayPal can’t prove conversion and merchant ROI improvements, it risks slow share erosion.

Mix pressure is real. PayPal’s transaction revenue doesn’t automatically grow with TPV; product mix can compress take rates.

Execution risk is the whole game. Fastlane needs adoption and measurable merchant outcomes, not just PR metrics.

Payments can look fine… until they don’t. Fraud losses, regulatory changes, and credit exposure can surprise.

This is why my PayPal thesis is not “it’s cheap, therefore it must go up.” It’s: the product and mix pivot is credible enough that the downside narrative looks overconfident.

We recently restarted our MultiBagger Portfolio at the beginning of the year because many legacy holdings had already matured — great outcomes, but not “early-phase” anymore.

The new portfolio is built to focus on early-stage asymmetry again, and it starts cash-heavy so we can deploy into fresh setups as they confirm.

PayPal obviously isn’t a microcap. It’s a different type of multi-bagger candidate: a large-cap platform with potential for a multi-year re-rating and EPS compounding. I’m sharing it publicly because it’s a clean example of the runway + product + profitability framework we use — and because I think investors are still underestimating how long PayPal can keep improving from here.

(Portfolio holdings and weightings remain Founding-only, as always that’s where we reward long-term subscribers. But the framework is the same.)

Disclaimer: This publication is provided for informational and educational purposes only and reflects the author’s opinions as of the date of publication. It does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell any security, and it should not be relied upon as the sole basis for making investment decisions. The author is not acting as your financial adviser and does not provide personalized investment, legal, tax, or accounting advice. You should conduct your own research, verify all information independently, and consult qualified professionals regarding your individual circumstances before acting on any information contained herein. Investing involves substantial risk, including the risk of losing all or part of your invested capital. Past performance is not indicative of future results, and any projections, forward-looking statements, targets, or estimates are not guaranteed and may change materially. Certain information may be obtained from third-party sources believed to be reliable; however, no representation or warranty is made as to its accuracy, completeness, or timeliness. The author and/or related parties may hold positions in the securities discussed and may buy or sell such securities at any time without notice. All investment decisions are made solely at your own risk.

Golly gosh I hope so🤞